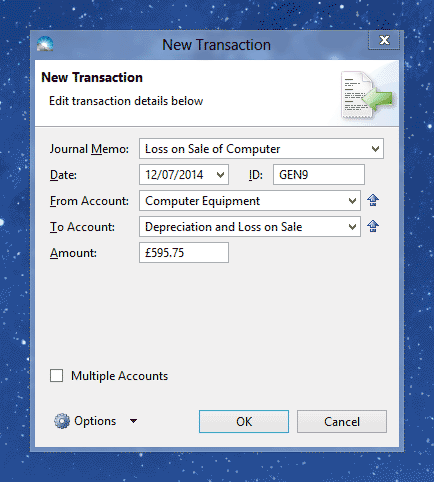

When you sell an asset, you will likely have made a profit or loss on the sale. In the above example, the computer was purchased for £868.09 and sold for £272.34 (the VAT-exclusive amounts are used because the business is registered for VAT). The business therefore made a loss of £595.75. To record this loss, click File > New > General Transaction:

To record a loss, the From Account should be the asset account and the To Account should be 'Depreciation and Loss on Sale'. To record a profit, the From Account should be 'Depreciation and Loss on Sale' and the To Account should be the asset account.