When you buy something that lasts several years, you should record it as an asset purchase. By allocating the payment to an asset account you exclude it from the Profit and Loss calculation.

However, over time the asset will wear out and need to be replaced - to account for this you should periodically record a depreciation expense. The depreciation transaction simply transfers part of the asset value to an expense account.

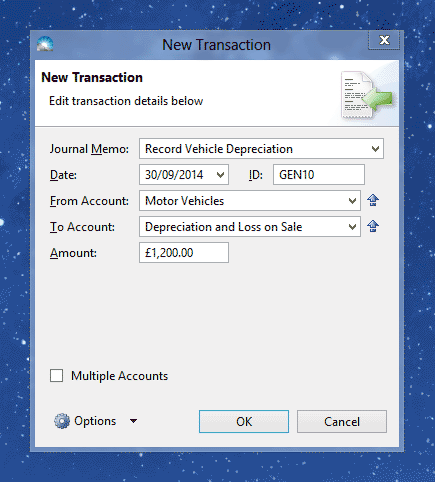

For example, to record depreciation on a van create a General Transaction from the 'Motor Vehicles' account to the 'Depreciation and Loss on Sale' account like this:

Click OK to save the transaction - it then appears in the Transaction list.