Some businesses pay an employee for the use of the employee's vechicle for business purposes. This should be recorded in Solar Accounts as an expense allocated to the Motor Expenses account.

How To Record VAT

If your business is VAT-registered, you should be aware that VAT does not usually apply to the full mileage payment. Only a portion of this cost is deemed to be for fuel and only this amount includes VAT.

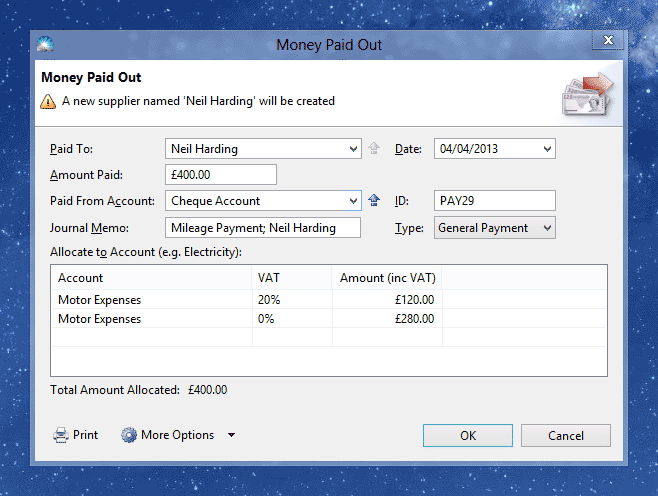

For example, suppose the employee has driven 1,000 miles and is paid 40p per mile, of which the fuel component is 12p per mile. (This fuel rate depends on the engine size - see the HM Revenue and Customs website for details). The mileage payment is therefore £400. Of this amount, only £120 includes VAT. To record this payment, click menu File > New > Money Paid Out and enter the following details:

Click 'OK' to save the payment. The new transaction will appear in the Transactions list (menu Window > Transactions).