Note: this information refers to PAYE and NI contributions by employees. (If you are self-employed or in a partnership and pay your personal tax from a business account, record this as a Non-Business Payment).

Pay-As-You-Earn (PAYE) and National Insurance (NI) contributions are one of the more complicated accounting procedures self-employed people have to perform.

Consider an employee who receives a monthly salary of £1,700.

HM Revenue and Customs will collect 3 types of 'tax' on this salary:

Let's assume the employee's PAYE is £250, Employee's NI is £145, and Employer's NI is £170. (For information on how to calculate these figures, see www.businesslink.gov.uk)

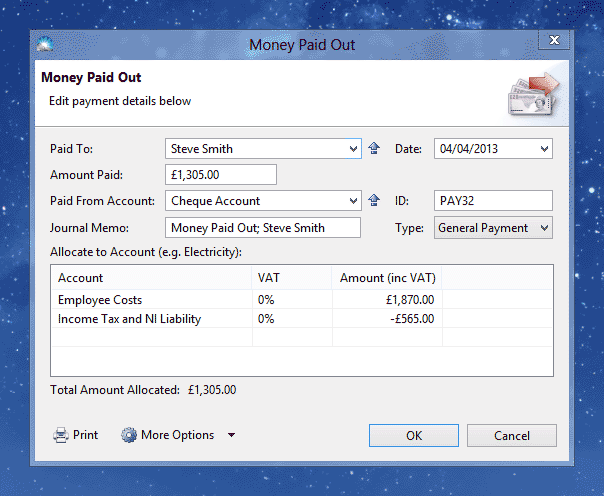

To record the salary payment, click menu File > New > Money Paid Out. The Money Paid Out window will be shown:

Note: The 'Income Tax and NI Liability' amount is negative. Also, the VAT Treatment (under 'More Options') should be set to Out of Scope

Enter the details of the salary into the following fields:

Paid To: Enter the name of the employee.

Date: The date the employee was paid.

Amount Paid: This is the amount the employee received. It should be the employee's gross salary less the PAYE and employee's NI contribution.

Paid From Account: The account used to make the payment, eg. 'Cheque Account'.

ID: A unique number to identify this transaction

Journal Memo: A description of this transation for your records.

Type: For employment expenses this should be set to 'General Payment'.

More Options > VAT Treatment (only shown if registered for VAT): For employment expenses this should be set to 'Out of Scope' as VAT does not apply to salary or wages.

Allocate to Account: For employment expenses you should enter two accounts: 'Employee Costs' and 'Income Tax and NI Liability'.

VAT Column (only shown if registered for VAT): This should be always be '0%' as VAT does not apply to salary or wages.

Amount: For 'Employee Costs', enter the employee's gross salary plus employer's national insurance contributions. (The employee's national insurance contributions are considered part of the salary). For 'Income Tax and NI Liability' enter the total PAYE, Employer's NI and Employee's NI contributions as a negative amount. This will increase the amount owed to HM Revenue and Customs.

Total Amount Allocated: The sum of the Amount column, and must equal the Amount Paid.

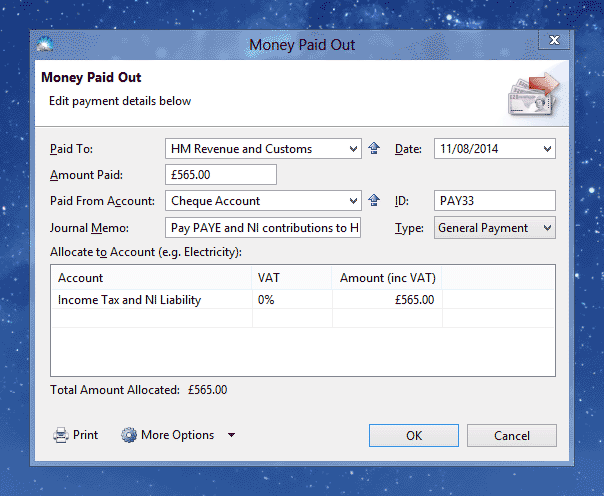

When the business pays the PAYE and NI contributions to HM Revenue and Customs, enter another Money Paid Out transaction:

Note: The Allocate to Account field should be 'Income Tax and NI Liability'. The VAT Treatment field (under 'More Options') should be 'Out of Scope'.

The net result of these two transactions is: The employer pays £1,870; the employee receives £1,305 and HMRC receives £565.