Tip: The new rates for the Flat Rate Scheme from 4 January 2011 are available on the HMRC website

The Flat Rate Scheme for VAT is a simplified way of calculating your VAT liability. To use this scheme, your annual turnover (excluding VAT) must be less than £150,000 and you must register with HM Revenue and Customs. For more information see VAT Notice 733 or call the HMRC National Advice Service on 0845 010 9000.

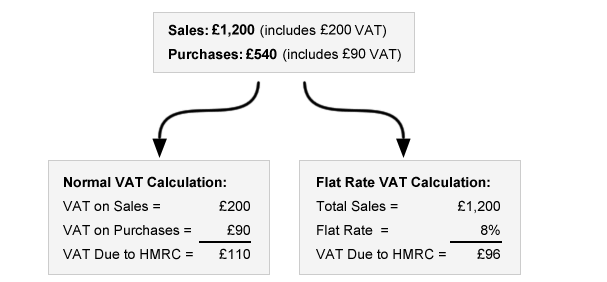

Here's an example showing the Flat Rate VAT Calculations:

In this example, the VAT liability under the Flat Rate Scheme is £14 less than under the normal VAT rules.

Note that the Flat Rate isn't always 8% - it depends on your type of business. Click here to find out the flat rate for your business type.

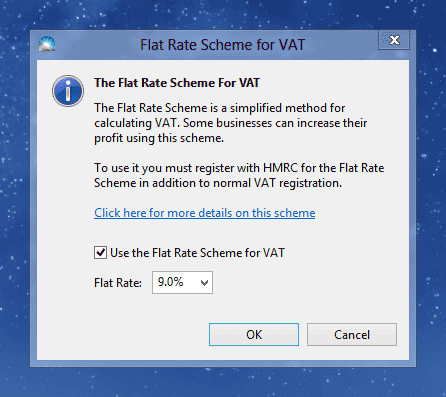

To set up Solar Accounts to use the Flat Rate Scheme, click menu Setup > Contact Details & VAT, then select 'Registered for VAT' and click the Flat Rate Scheme link:

Now select 'Use the Flat Rate Scheme for VAT', enter the flat rate for your business and click OK:

HM Revenue and Customs may allow you to apply a 1% discount to the Flat Rate for the first year your business is VAT-registered. This discount should be included in the Flat Rate field above. When the discount period ends, change the Flat Rate field to exclude the discount — existing transansactions will use the old rate while new transactions will use the new rate.

When you enter a new purchase you should continue to enter the normal rate (usually 20%) in the VAT column. This rate will not affect your VAT return but will be used when calculating how much of your profit is due to the Flat Rate Scheme.

Under the Flat Rate Scheme, you cannot normally reclaim VAT you have paid on purchases. However, an exception applies to some capital purchases valued above £2,000 – see the HMRC website for details about which transactions qualify for this exception.

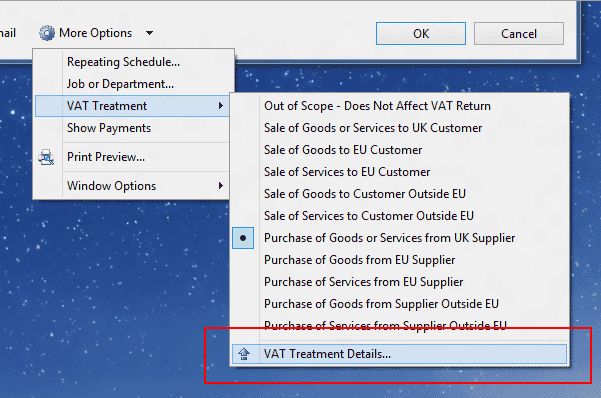

To reclaim the VAT on a purchase, open the purchase transaction window and click More Options > VAT Treatment Details:

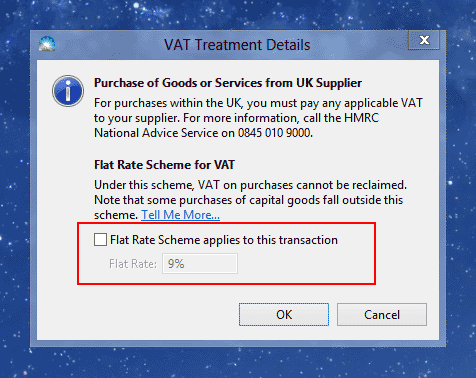

Then deselect the Flat Rate Scheme checkbox and click OK:

The VAT on this transaction will then be calculated under normal VAT rules, allowing you to reclaim the VAT you have paid. Note that if you later sell the capital asset, you should also exclude the sale from the Flat Rate Scheme in the same way.

If you calculate your VAT due based on payments (rather than invoices) you will also need to explicitly apply the flat rate to any invoices that were outstanding on the date you became registered for the scheme. To do this:

1. Go to the Reports list and select 'Outstanding Invoices' report

2. Click 'Configure' (next to the report title) and set the 'As of Date' to be the day before you became registered for the flat rate scheme

3. Open each invoice shown and click More Options > VAT Treatment > More VAT Options

4. Tick 'Flat Rate Scheme applies to this transaction' and click OK

5. Repeat steps 1-4 with the 'Outstanding Purchase Invoices' report

You will also need to apply this procedure if you exit the flat rate scheme.

If you leave the Flat Rate Scheme, click menu Setup > Contact Details & VAT > Click here if you use the flat rate scheme, then deselect 'Use Flat Rate Scheme'. Note this change will only apply to new transactions — existing transactions will still fall under the Flat Rate Scheme.