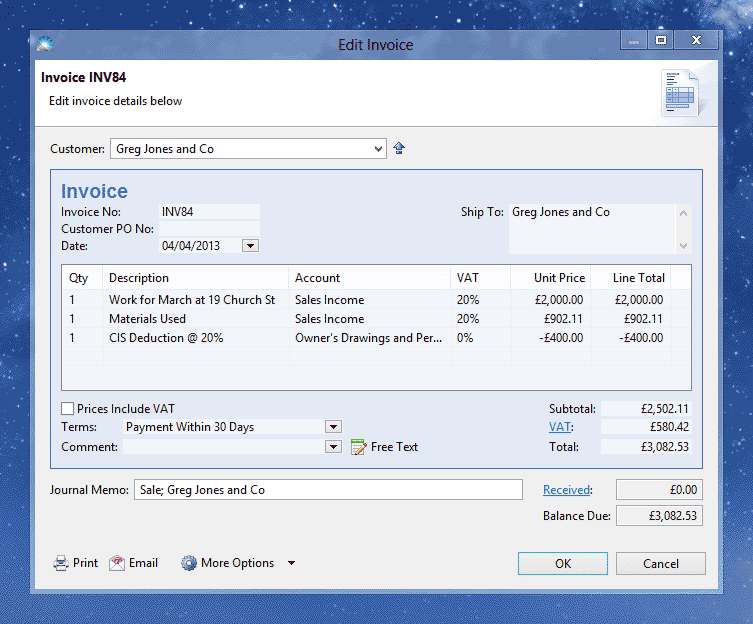

As a subcontractor covered by the construction industry scheme, your invoice should include a deduction for tax and NICs. To create this invoice, click menu File > New > Invoice.

Enter the usual details for an invoice, then enter another invoice line for the CIS deduction:

There are several points to note about the CIS deduction line:

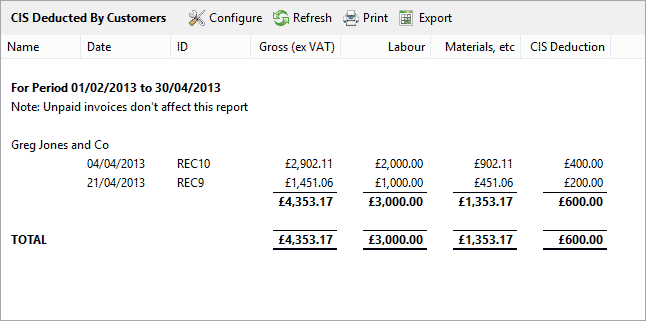

You can periodically reclaim these deductions from HMRC - for self-employed people this will happen when you complete your annual income tax return. To find out the total CIS amounts deducted from customer payments, click menu Window > Reports, then select the 'CIS Deducted By Customers' report.

Note that this report is based on payments made by customers - if an invoice is unpaid it will not affect this report.