Note: This text only applies to businesses registered for VAT in the UK.

If you make purchases from another EU country your supplier will often not charge VAT. However, there may be times when your supplier charges you VAT at the rate applicable in their country. (If unsure whether you should be charged VAT, contact the HMRC helpline on 0845 010 9000). Here's how to record these purchases in Solar Accounts:

Step 1: Create a new account to track EU VAT

Click menu File > New > Account. Ensure the Account Type is Asset and set the Account Name to 'EU VAT To Reclaim', then click OK. This new account will keep track of the VAT you have paid to EU suppliers but not yet recovered from the VAT authorities.

Step 2: Record the purchase

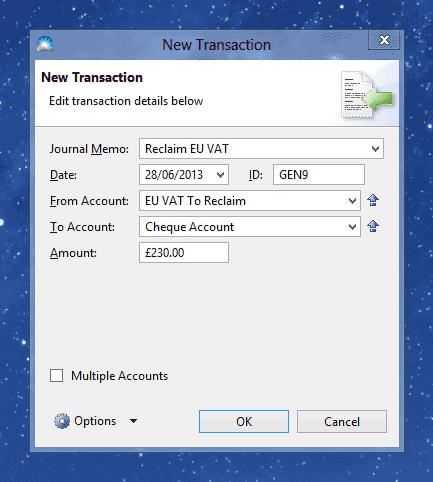

Enter the purchase as either a Purchase Invoice or a Money Paid Out transaction with Type set to 'General Payment'. Set the VAT Treatment field (under 'More Options') to 'Out of Scope' and add an extra line for the VAT allocated to 'EU VAT To Reclaim'. Here's an example:

Step 3: Reclaim the EU VAT

The simplest way to do this is to apply for a refund using 'Reclaim EU VAT' service on the HMRC website - see this web page for details, or call the HMRC advice line on 0845 010 9000. (Note that EU VAT should not be reclaimed on the normal UK VAT return - there is a separate process for reclaiming EU VAT).

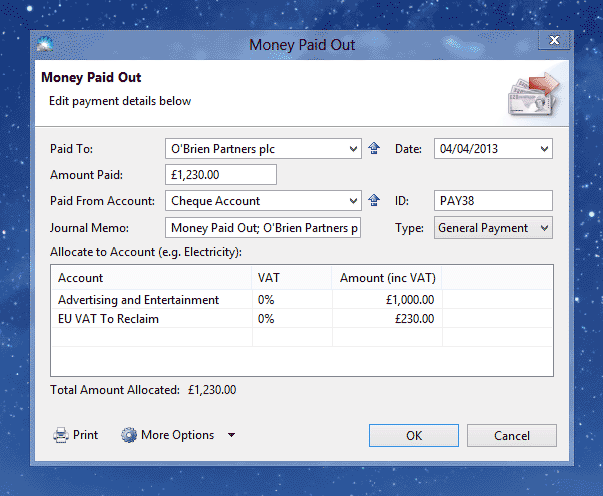

Your refund will be paid directly into your bank account. To record this payment, create a General Transaction from the 'EU VAT To Reclaim' account to the Cheque Account as shown below: