A scale charge is a way of calculating your VAT on road fuel bought by a business that is then put to private use. If you use the scale charge, you can reclaim all the VAT charged on road fuel without having to split your mileage between business and private use. For more information, see Section 9 of VAT Notice 700/64.

Under this scheme you should record fuel purchases as a normal expense allocated to the Motor Expenses account.

At the end of your VAT period you must also record a transaction to account for the personal use of the fuel.

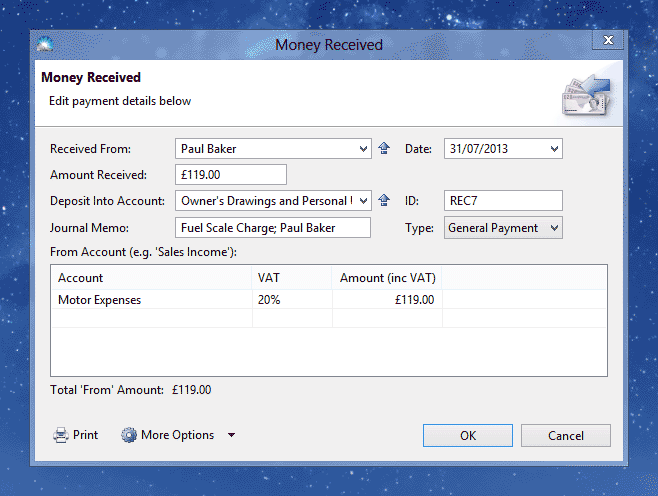

Click menu File > New > Money Received:

If the fuel was used by an employee the Deposit Into Account should be 'Employee Costs'. For self-employed individuals the Deposit Into Account should be 'Owner's Drawings and Personal Use'.

The amount should be the scale charge as described in Section 9 of VAT Notice 700/64.

Click OK to save the transaction - this records the fuel scale charge.

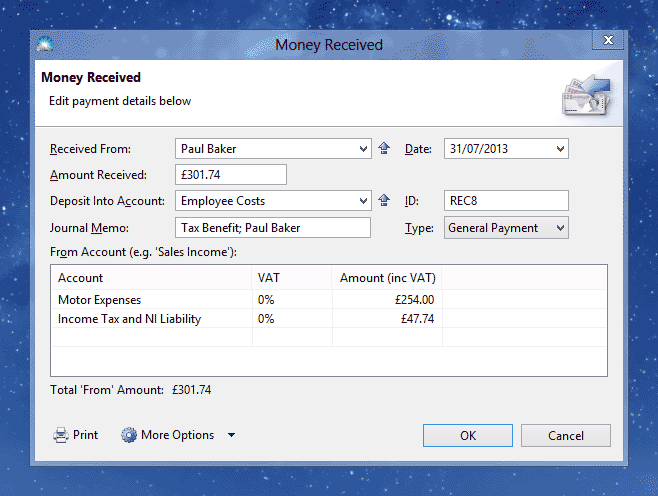

If the fuel has been used by an employee (rather than self-employed individual) then HMRC considers that employee to have received a 'Fuel Tax Benefit'. Generally, this Fuel Tax Benefit exceeds the VAT fuel scale charge amount. You therefore need to record another transaction to account for this excess.

To calculate the Tax Benefit on the fuel see the HMRC Fuel Benefit Calculator. Part of this benefit has been recorded by the Fuel Scale Charge transaction above. To record the remainder of the benefit, click menu File > New > Money Received.

The VAT Treatment (under 'More Options') should be set to 'Out of Scope'. The From Account table should include an entry for Class 1A National Insurance Contributions. The Amount Received is the Tax Benefit (as calculated above) plus the Class 1A NIC amount less the VAT Fuel Scale Charge. The Deposit Into Account should be 'Employee Costs'.

For more information on VAT Fuel Scale Charges talk to your accountant or call the HMRC National Advice Service on 0845 010 9000.