From 1 March 2021 HMRC require that the 'Domestic Reverse Charge for VAT' apply to transactions in the construction industry. Here's how to record such transactions in Solar Accounts.

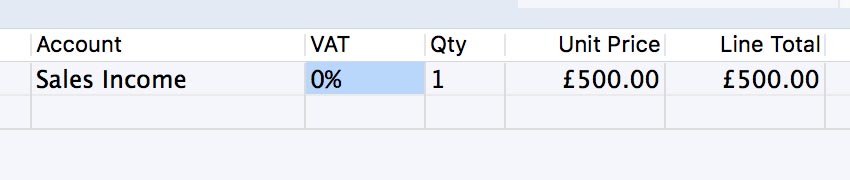

In the invoice window (or purchase invoice window) set the VAT rate to 0%

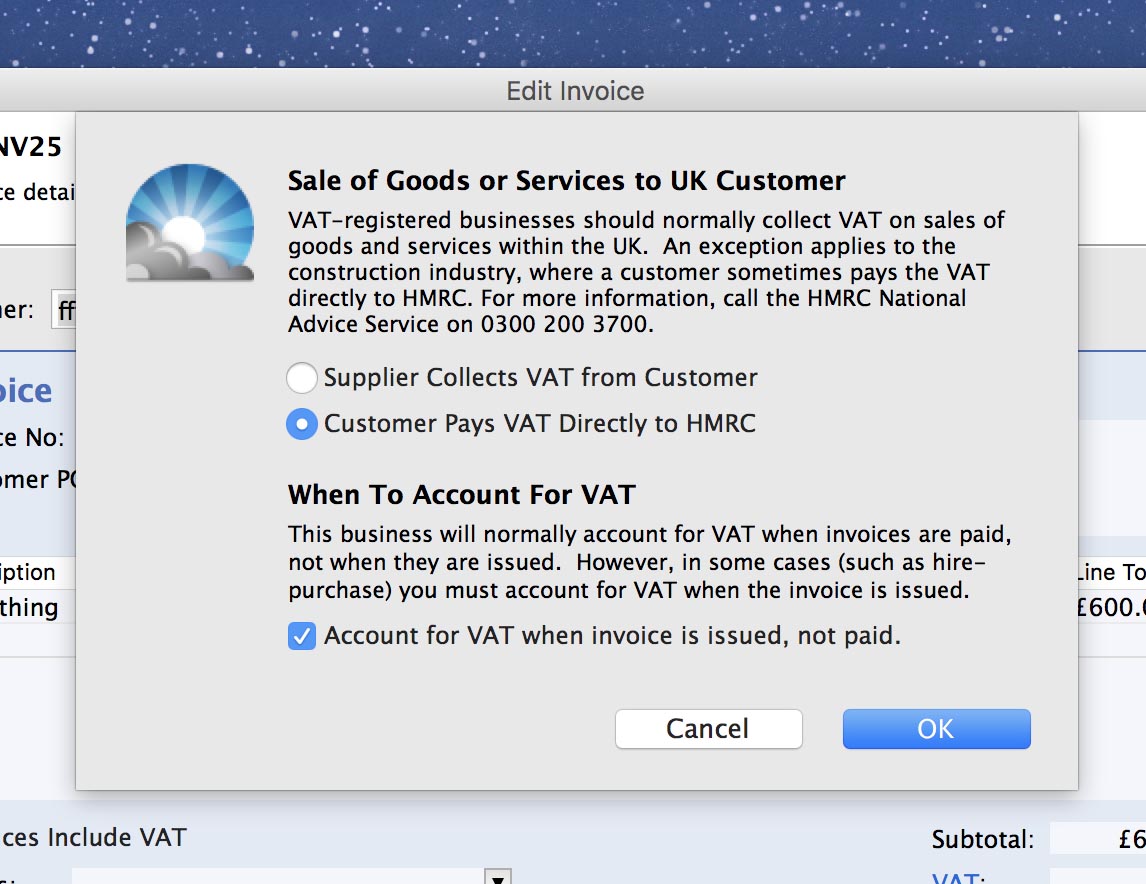

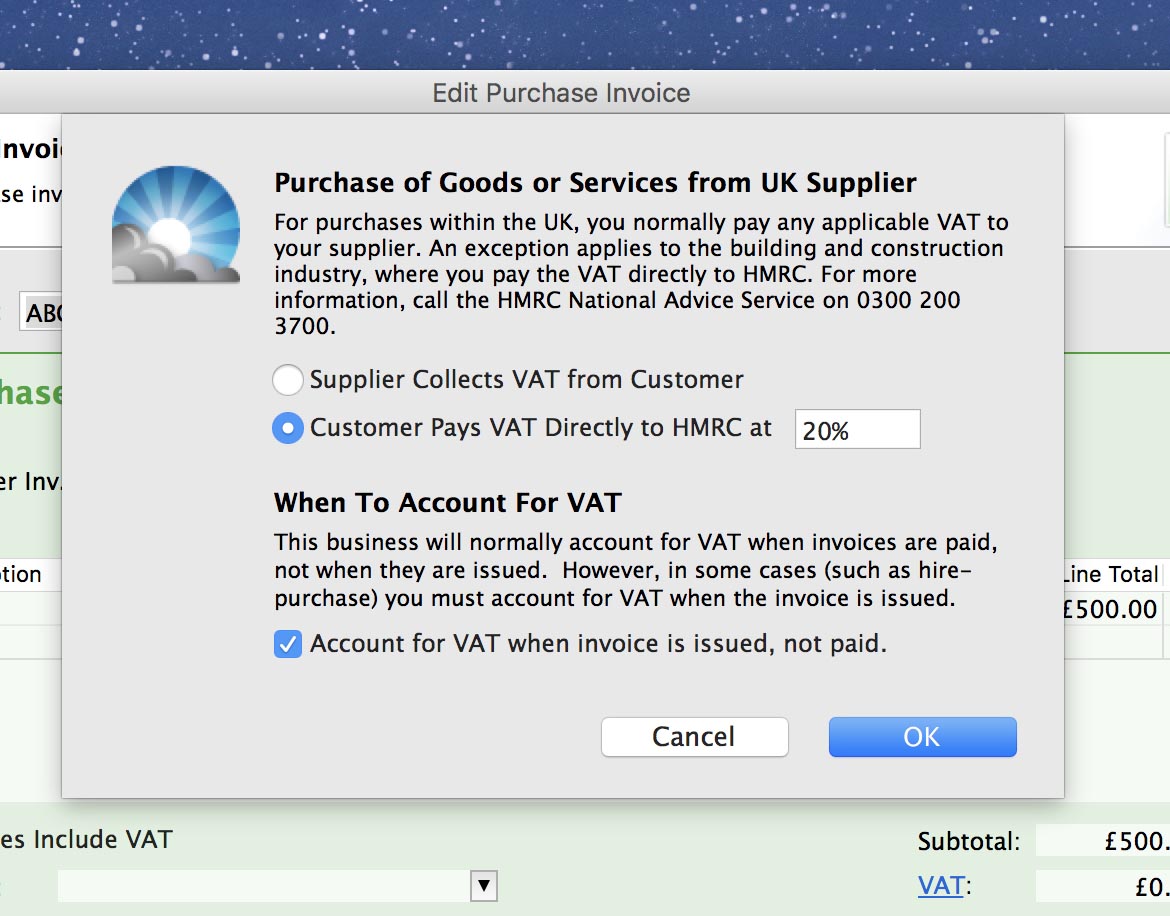

At the bottom of the invoice window click More Options > VAT Treatment > More VAT Details,

then select 'Customer Pays VAT directly to HMRC' and 'Account for VAT when invoice is issued, not paid'.

For sales invoices, the VAT settings window should look like this:

For purchase invoices, the VAT settings window should look like this:

Click OK to apply the VAT settings

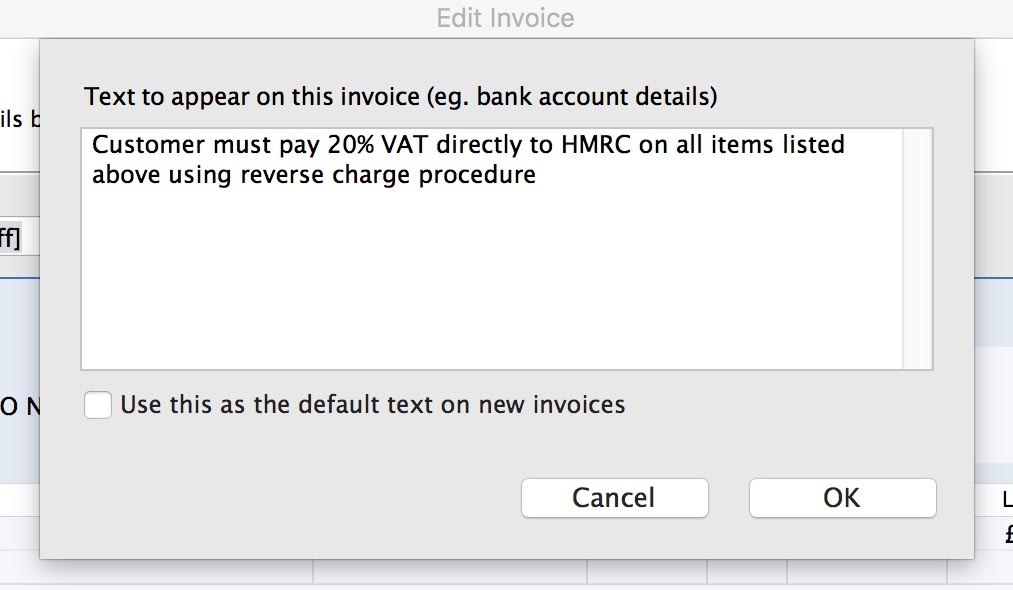

Step 3For sales invoices, click 'Free Text' and set the text to "Customer must pay 20% VAT directly to HMRC on all items listed above using reverse charge procedure".

To avoid any doubt about the rate of VAT, we also recommend removing the VAT column and VAT total fields on the invoice template as described here.