The accounting treatment of hire-purchase agreements can be complicated, particularly if it involves the part-exchange of and old asset and the business is registered for VAT. Solar Accounts has features to simplify the process but you will still need be carful to calculate the correct figures and enter the appropriate transactions.

From an accounting perspective, a hire purchase agreement is simply a loan you take to buy an asset such as a vehicle. The trade-in of an old vehicle is recorded as a sale. To see how record a hire-purchase agreement in Solar Accounts let's look at the following example involving the purchase of a new van:

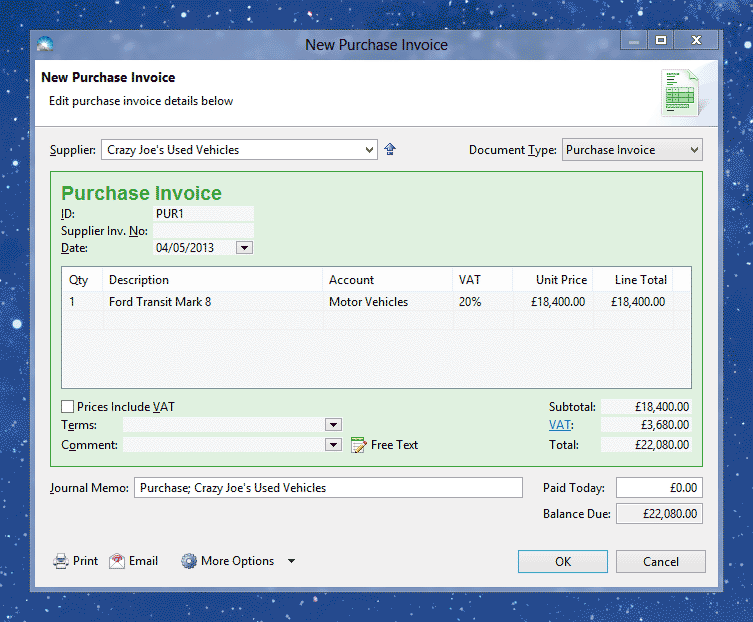

Step 1: Record the purchase of the new van

Create a purchase invoice with £22,080 allocated to the 'Motor Vehicles' account:

There are two unusual issues related to VAT on this purchase that you should consider:

If you normally account for VAT when an invoice is paid, not issued: You cannot use such an approach for hire-purchase agreements. Therefore, in the purchase invoice window click More Options > VAT Treatment > VAT Treatment Details, and tick 'Account for VAT when this invoice is issued, not paid.'

If you are registered to use the Flat Rate Scheme for VAT: Purchases of capital goods above £2,000 do not normally fall under this scheme. Therefore to allow Solar Accounts to correctly calculate your gain (or loss) under this scheme click More Options > VAT Treatment > VAT Treatment Details, and remove the tick next to 'Flat rate scheme applies to this transaction'. For more information see 'Reclaiming VAT on Capital Purchases' on this page.

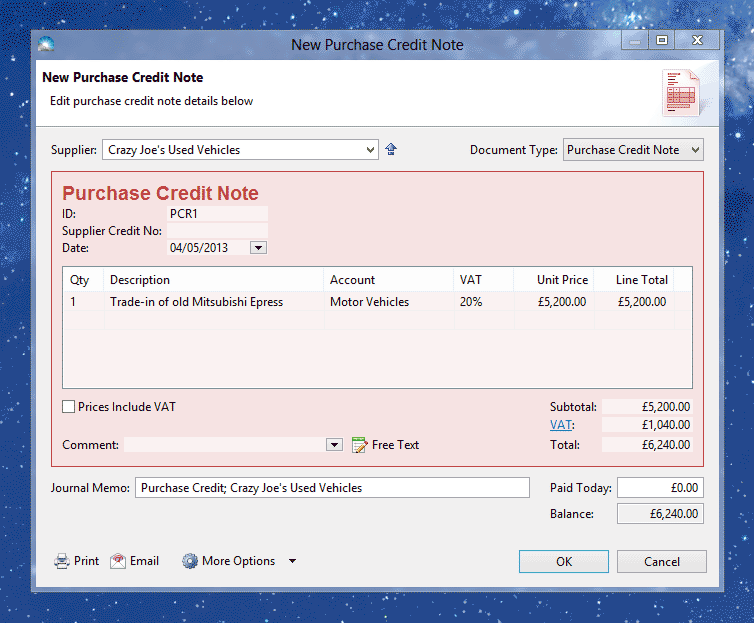

Step 2: Record the sale of the old van

Create a purchase credit note for £6,240 allocated to the 'Motor Vehicles' account:

If you are VAT-registered click More Options > VAT Treatment > Sale of Goods or Services to UK Customer. In addition, the same VAT issues mentioned in Step 1 also apply to this sales invoice:

If you normally account for VAT when an invoice is paid, not issued: Click More Options > VAT Treatment > VAT Treatment Details, and tick 'Account for VAT when this invoice is issued, not paid.'

If you are registered to use the Flat Rate Scheme for VAT: Click More Options > VAT Treatment > VAT Treatment Details, and remove the tick next to 'Flat rate scheme applies to this transaction'.

Step 3: Allocate the credit note to the purchase

Ensure that the purchase credit note you created in Step 2 is selected, then click menu File > New > Allocate Selected Credit and tick the purchase invoice you created in Step 1. This will reduce the amount owing on the purchase invoice. For more information, see How to Allocate a Credit Note to a Purchase.

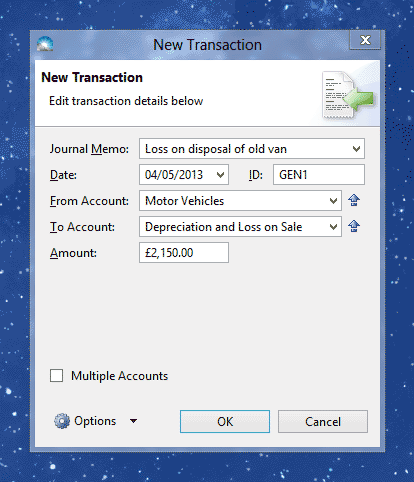

Step 4: Record a loss (or gain) on the sale of the old van

The 'sale price' of the old vehicle will probably not match the residual value of the vehicle. (The residual value is the original purchase price less total depreciation that has been written off over the years). It is important to record the difference as a loss (or gain) as this will affect the amount of income tax the business will incur at the end of the financial year.

In this example let's assume the original purchase price of the old van was £12,000 and the total depreciation written off in previous years was £4,650. (This business is VAT-registerd so we use the purchase price excluding VAT). The residual value of the old van is therefore £7,350 and since we are now selling the van for £5,200 (excluding VAT) the loss on this sale is £2,150:

For more information, see 'Recording a Profit or Loss on the Sale' on this page.

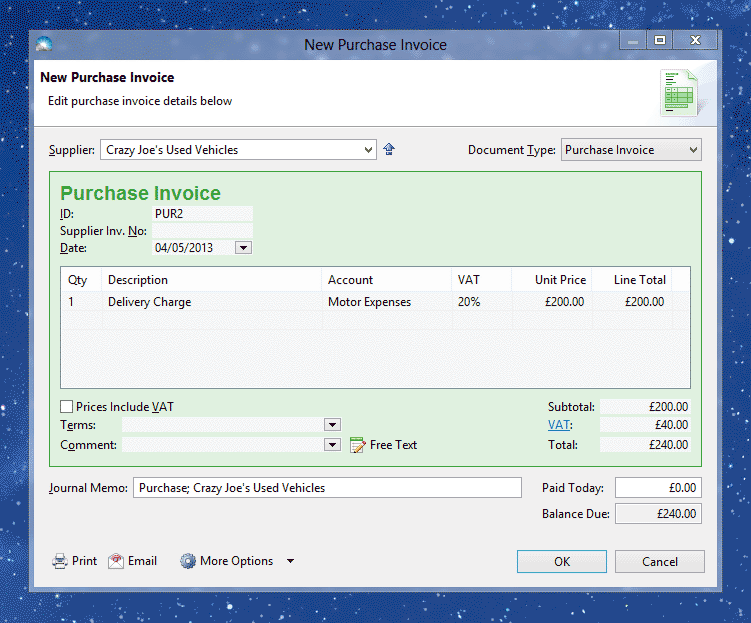

Step 5: Record the delivery charge

The delivery charge is treated as an expense (ie. it is not included in purchase price of the van) because the value of this item is 'used up' immediately. To record the expense create another Purchase Invoice, this time for £240 and allocated to the Motor Expenses account. The two VAT issues mentioned in Step 1 do not apply to this purchase invoice.

Step 6: Record the deposit

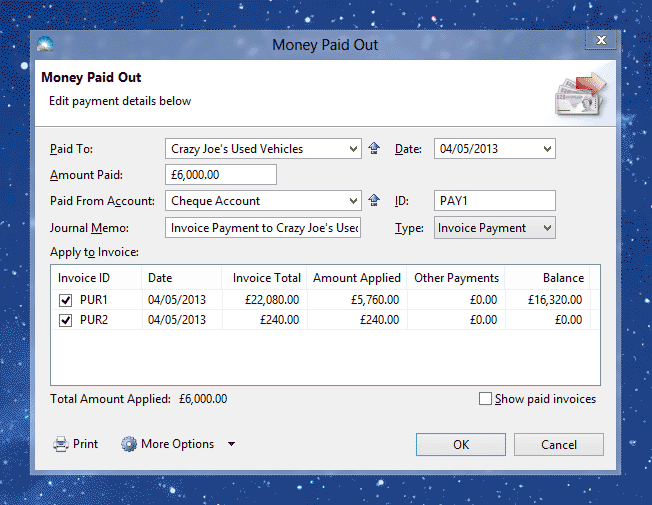

Create a new purchase invoice payment for £6,000, with £240 allocated to the purchase invoice from Step 5, and £5760 allocated to the purchase invoice you created in Step 1:

See this page for details on how to record a purchase invoice payment.

Step 7: Record the monthly repayments

Solar Accounts cannot record the monthly repayments in a single transaction - the interest component must be recorded separately from the repayment of loan principal. We therefore need to work out the interest amount for each repayment.

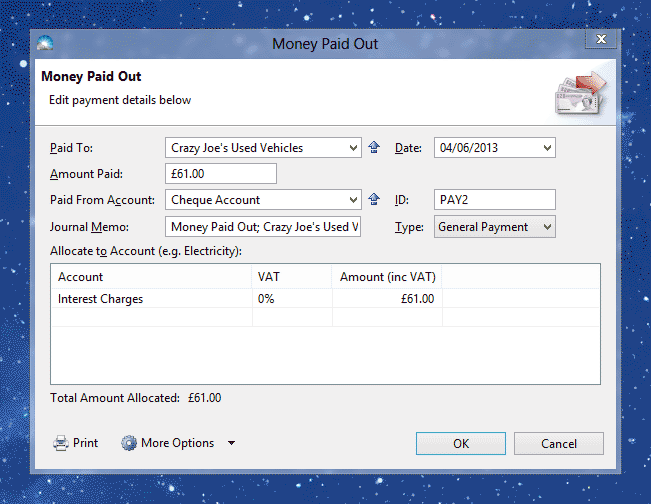

In our example the balance of the purchase invoice created in Step 1 is now £10,080. The 36 repayments total £12,276, so the total interest charge is £2,196, or £61 per month. Record this interest cost as a Money Paid Out transaction with Type set to 'General Payment' and allocated to 'Interest Charges':

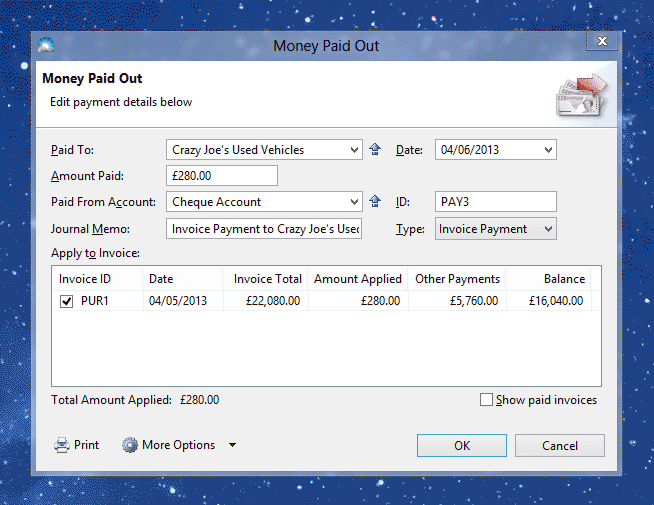

The remaining £280 is the amount of loan principal repaid - this should be recorded as a purchase invoice payment:

After all 36 monthly payments have been recorded the balance of the purchase invoice created in Step 1 should be zero. (Note: You may need to adjust the final amounts of the final interest and principal transactions slightly to account for rounding)